What To Do When Home Appraisal Value Falls Short of the Offer Price

The excitement of finding the perfect home can be tempered when the appraisal value comes in lower than the offer price. This situation can pose challenges for both buyers and sellers, requiring careful consideration and strategic decision-making. In this article, we will explore the steps and options available to parties involved when the home appraisal […]

Understanding How Much Money You Can Get with a HELOC

Homeownership opens doors to various financial opportunities, and one such avenue is the Home Equity Line of Credit (HELOC). A HELOC allows homeowners to tap into the equity built in their property, providing a flexible and accessible source of funds. In this article, we’ll explore how a HELOC works and delve into the factors that […]

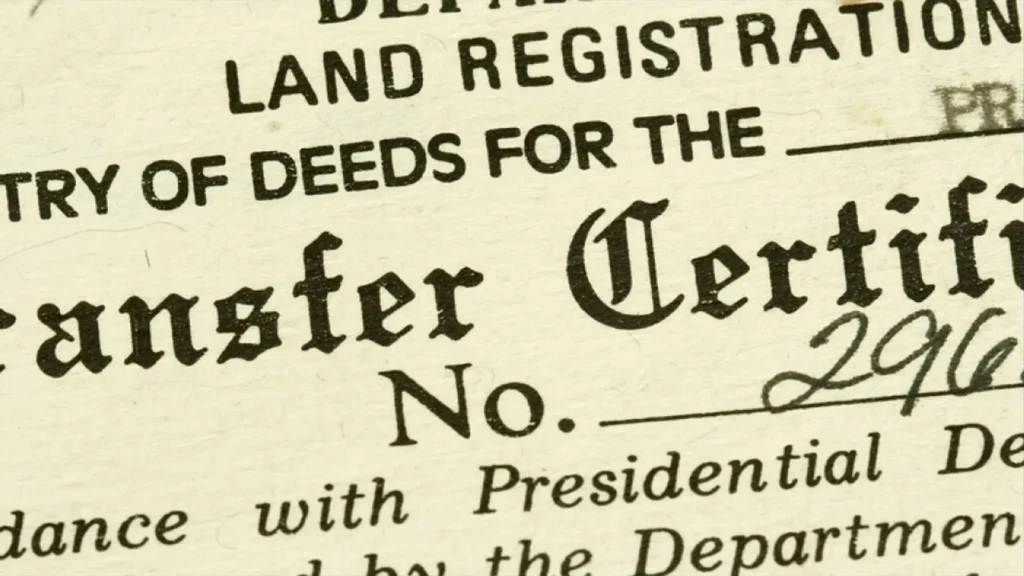

Empowering Homeowners: Cities and Counties Step Up to Monitor Property Titles

In a bid to protect homeowners from fraudulent activity and ensure the integrity of property transactions, an increasing number of cities and counties across the country are offering services to monitor the titles of residential properties. This proactive approach represents a significant development in the realm of property rights and underscores the growing importance of […]

Federal Reserve Hints at Potential Interest Rate Cut: Insights from NY Fed’s John Williams

In a significant development that has sent ripples through financial markets, John Williams, the president of the Federal Reserve Bank of New York, has hinted at the possibility of an interest rate cut in the foreseeable future. Williams’ remarks come amidst growing concerns about inflationary pressures and economic recovery following the global pandemic. Speaking at […]